What is the nonforfeiture value of an annuity? This question delves into the intricate world of annuities, where understanding this crucial concept empowers individuals to make informed decisions about their financial future.

Nonforfeiture value plays a pivotal role in annuity contracts, ensuring that policyholders retain a guaranteed minimum value even if they discontinue premium payments. This article provides a comprehensive exploration of nonforfeiture value, its calculation, types, uses, and its impact on annuity design and regulations.

Definition of Nonforfeiture Value

The nonforfeiture value of an annuity refers to the minimum guaranteed amount that an annuitant is entitled to receive from the insurance company if they choose to terminate or surrender their annuity contract before the end of its term. It represents the value of the annuity’s accumulated premiums and investment earnings, less any surrender charges or fees.

Calculation of Nonforfeiture Value

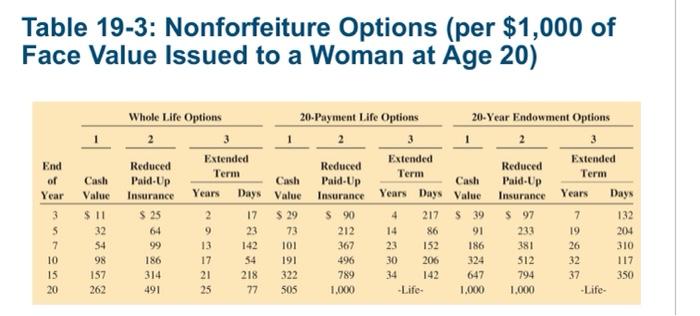

The nonforfeiture value is typically calculated using a formula that takes into account the following factors:

- The amount of premiums paid into the annuity

- The interest rate credited to the annuity

- The surrender charge period (if any)

- The mortality table used to calculate the annuitant’s life expectancy

Types of Nonforfeiture Values

There are two main types of nonforfeiture values:

- Cash surrender value: This is the amount of money that the annuitant can receive if they surrender their annuity contract before the end of its term.

- Paid-up insurance value: This is the amount of annuity income that the annuitant is guaranteed to receive for the rest of their life, regardless of when they surrender their contract.

Uses of Nonforfeiture Value

The nonforfeiture value of an annuity can be used by annuitants in a variety of ways, including:

- To provide financial security in the event of an emergency

- To supplement retirement income

- To purchase a new annuity contract

- To pay off debts

Popular Questions: What Is The Nonforfeiture Value Of An Annuity

What is the significance of nonforfeiture value in annuity contracts?

Nonforfeiture value ensures that annuity holders receive a minimum guaranteed value even if they stop making premium payments, protecting their investment and providing financial security.

How is nonforfeiture value calculated?

Nonforfeiture value is typically calculated using formulas that consider factors such as premiums paid, the interest rate, and the annuity’s surrender period.

What are the different types of nonforfeiture values?

Common types of nonforfeiture values include cash surrender value, which allows policyholders to withdraw a portion of their accumulated value, and paid-up insurance value, which provides a reduced level of coverage without further premium payments.

How can nonforfeiture value be used by annuity holders?

Nonforfeiture value provides flexibility and financial security, allowing holders to access funds for emergencies, supplement retirement income, or cover unexpected expenses.